Technocrats Horizons - Empowering Finance with Tailored Solutions

Client engagement and inefficient operations always create hurdles for finance businesses to achieve effective growth.

Technocrats Horizons, the leading finance software development company, understands these hurdles and offers smart, AI-powered fintech solutions that allow finance businesses to fuel effective growth and success in the digital landscape. From simplifying lead generation to automating compliance checks to effective portfolio management, our fintech solutions ensure you can easily embark on a successful journey with enhanced client engagement and workflow efficiency.

We believe in delivering quality rather than mere solutions, and that's why we follow an agile development approach to have detailed insights into your needs and challenges and craft digital experiences tailored to your unique needs and goals. Quality solutions do not mean hefty pricing. Rather, we make finance software development accessible for businesses of every size and the most affordable. So, whether you are a startup or an SMB, enhancing operational efficiency and client engagement becomes easier and more cost-effective with Technocrats Horizons.

Finance Sectors Benefited By Our Fintech

Services

Our custom fintech software development services drive efficiency and growth in different finance sectors.

Mortgage Brokers and Lenders

Wealth management and Investment Firms

Financial Advisors and Planners

Educational Loan Consultants

Car Loan and Vehicle Finance Companies

Insurance Brokers and Agencies

P2P Lending Platforms

Finance Startups

Navigating the Key Challenges Faced by the

Finance Sector

The finance industry faces several challenges that hinder operational efficiency and client engagement, resulting in ineffective growth and success. However, with our solutions, finance institutes can overcome these challenges, ensuring sustainable development.

Issues in Lead Generation and Client Engagement

The absence of comparison tools and calculators often confuses finance clients when choosing from varied options, which ultimately makes them leave the application without making a purchase. Our solutions, like loan comparison tools and calculators, allow clients to compare the available options and make calculations, which enable clients to make more effective choices smartly.

Keeping Up With Evolving Regulatory Compliance

With the finance industry constantly getting updated with new regulations, it becomes difficult for finance institutes to keep up with the new regulations, resulting in costly penalties. Our AI-powered solutions automate the compliance process, allowing you to always stay updated with the updated rules.

Increasing Risk of Cyber Threats

Financial organizations handle a huge amount of client data, which is prone to data breach activities. Our security solutions provide advanced safety measures like data encryption and multi-layered protocols, ensuring your sensitive data stays protected always.

Slow and Inefficient Loan Processing

Loan approval processes involve manual checks, which are time-consuming and error-prone, leading to frustration among the clients. Our loan management solutions automate the loan approval process from application verification and approval, leading to an enhanced customer experience.

Lack of Personalization in Financial Offerings

Financial institutions have large customer bases with diverse needs, which makes it challenging to know individual needs and address them with tailored offerings. Our AI-powered solutions let you have detailed insights into individual needs and recommend financial products perfectly tailored to individual needs.

Scattered Financial Data

Financial data scattered on multiple platforms makes it challenging to manage and access it which leads to poor workflow efficiency. Our data integration solutions offer a centralized way to organize and access all your financial data in one place, streamlining operational efficiency.

Lack of Transparency in Financial Reporting

Financial businesses often struggle to track accurate information related to investments made by clients. The lack of accuracy in financial reports leads to trust issues among the clients. Our automated reporting solutions offer precise and real-time insights, helping you build trusting relations with your clients.

Difficulty in Managing Partnerships and Affiliates

With multiple partners and affiliates connected, it becomes challenging for financial businesses to manage these relationships with smooth communication. Our partner management solutions and affiliate portals allow you to track and manage the partnerships by streamlining interactions, allowing you to build seamless partnerships.

Our Fintech Software Development

Services to Propel Your Business

Operational efficiency and client engagement are the major drivers for the success of financial business. Being a leading fintech software development company, we offer services that help you refine growth in terms of efficiency and engagement.

1. Custom Web Development

With every finance business having unique needs, we craft smart and interactive web applications tailored to your business needs. From SEO-optimized platforms to interactive tools like booking platforms, we ensure your website effectively converts visitors into loyal clients.

2. Mobile Application Development

In today's mobile-first era, a high-performing mobile application is essential to keep your clients connected and engaged with your business. Our fintech app development services offer intuitive mobile applications for loan application and client communication to connect clients with your financial services at their own pace.

3. Digital Transformation

The finance industry keeps on evolving at a faster pace which makes it necessary for financial institutions to leverage leading technologies and tools to keep up with the market trends. Our digital transformation services allow you to modernize your operations with AI-powered tools and scalable solutions to future-proof your business in every way.

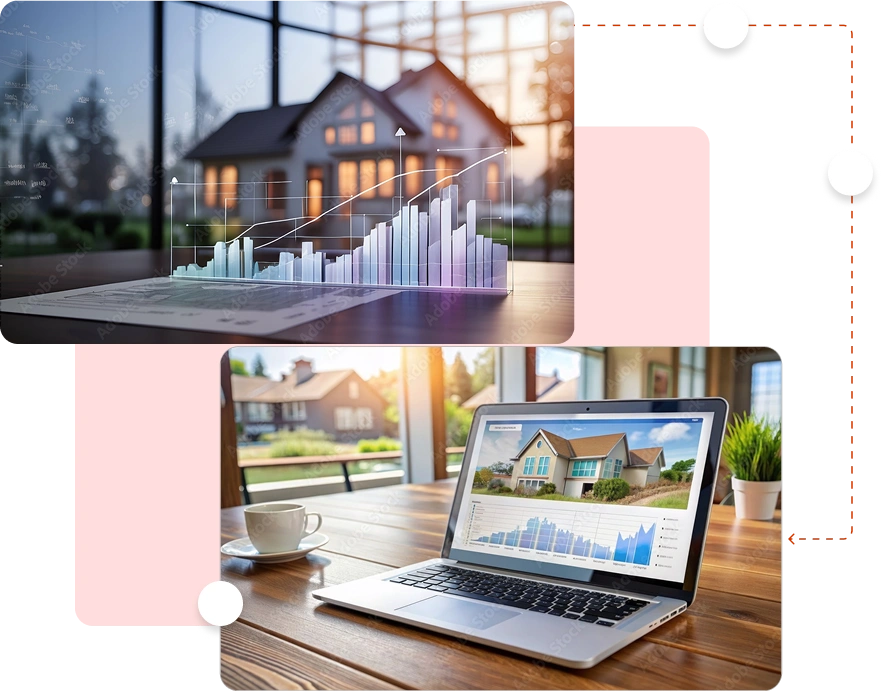

4. Software Integration and Third-Party Integration

Finance businesses need to rely on multiple platforms like loan management solutions and reporting systems for smooth functioning. Our fintech software development services help you integrate all the necessary solutions at a centralized location to ensure the effortless operation of your workflows.

5. SAAS Development

For finance businesses, scalability being the prominent factor to embed a large client base, we offer fintech SaaS solutions that are flexible enough to adapt easily to your evolving needs. Our SaaS platforms are robust and scalable to help financial services have effective growth.

6. MVP Development

Being a leading financial software development company, we understand that fintech custom software development involves a hefty investment. Our MVP development services allow you to turn your vision into reality without breaking the bank by embedding minimum, essential features in your web solution.

7. Digital Marketing

With the finance industry turning competitive every day, it becomes necessary to have effective online visibility to outshine your competitors. Our digital marketing services help you groove your online presence and generate effective leads with impactful strategies.

8. UI/UX Design

The user interface and design of a web or mobile application play a crucial role in its success. Our UI/UX designers craft compelling and easily navigable digital experiences that are strong enough to keep your clients engaged with your application.

Custom Web Development

With every finance business having unique needs, we craft smart and interactive web applications tailored to your business needs. From SEO-optimized platforms to interactive tools like booking platforms, we ensure your website effectively converts visitors into loyal clients.

Mobile Application Development

Digital Transformation

Software Integration and Third-Party Integration

SAAS Development

MVP Development

Digital Marketing

UI/UX Design

Our Fintech Software Solutions to Make

Your Business Future-Ready

In the rapidly evolving finance market, you need solutions that could thrive in long-term success. We offer leading-edge fintech solutions that help banking and finance businesses to have successful growth in terms of scalability and efficiency for years.

Investment and Stock Trading App Development

Our custom investment and stock tracking solutions offer a seamless way for your finance clients to manage their investments. From tracking investments to buying and selling stocks to getting real-time insights, our custom investment management solutions offer a seamless trading experience by simplifying complex processes.

KYC Platform Development

With KYC being a necessary yet the most challenging measure for user authentication, our KYC solutions offer a secure and robust way for financial businesses to identity verification and compliance management. With features like data scanning and facial recognition, we allow an easy pathway for regulatory compliance without compromising security.

Insurance Software Development

Our comprehensive insurance solutions allow a centralized way for insurance providers for policy management, quote generation, and claim processing. This allows insurance businesses to boost workflow efficiency and customer experiences.

Fintech CRM Software Development

Maintaining healthy relations with clients is the key to success for any financial firm. Our fintech CRMs allow businesses to effectively manage client interactions in a centralized way by allowing beneficiaries to track leads, manage portfolios, and automate mundane tasks, ensuring strong client relations for years.

P2P Lending Platform Development

Our fintech custom software development services offer a secure and transparent way for lending businesses to connect lenders and borrowers with P2P lending platform solutions. With features like user authentication and secure payment gateways, we ensure you offer a safe environment to the parties involved.

Finance Management App Development

We allow your clients to manage their finances with our finance management applications. Our solutions enable expense tracking and setting budgets to help clients make informed decisions and achieve their financial goals with ease.

Digital Wallet Development

With the high-level increase in digital cashflows, our digital wallet applications offer a seamless and secure way for clients to manage their online payments with features like easy fund transfers, multiple payment gateways, and advanced security measures.

Online Banking Software Development

As one of the top-notch financial app development companies, we make online banking experiences smoother with banking solutions empowered with functionalities like account management, loan applications, money transfers, and bill payments.

Financial Fraud Detection Software

With the rise in fraudulent activities, it becomes crucial for banking and financial services to protect customer data and assets. Advanced AI/ML algorithms accompany our financial fraud detection solutions to monitor real-time transactions and flag suspicious activity, eliminating the risks of fraudulent activities.

Ready to revolutionize your financial operations? Let's build something tailored to your needs!

BOOK A FREE CONSULTATION

Prominent Features of Our Fintech

Software Solutions

Being a prominent finance app development company, we aim to simplify complex workflows of financial businesses. That's why our fintech solutions are accompanied by remarkable features that help companies foster growth and efficiency with ease.

User Registration and Authentication

Our fintech app solutions offer Multi-Factor Authentication (MFA) and KYC checks to verify identities during the onboarding process, protecting user data while following regulatory compliance.

Online Booking and Consultation

Our booking system makes it easy for clients to connect with your financial firm and resolve their queries by allowing appointment scheduling.

Personalized Recommendations

Our AI-powered financial solutions help you analyze user behavior and browsing data to recommend financial solutions in terms of loans and investments tailored to their needs and preferences.

Loan Application and Tracking

Our solutions streamline the lengthy loan approval processes by offering easy-to-fill forms and allowing real-time loan tracking, which enhances customer experience and satisfaction.

AI-Powered Chat Support

Our AI-driven chatbots and virtual assistants allow financial firms to enhance their customer services by offering 24/7 instant support to client queries related to their application and account status.

Loan and Mortgage Calculators

Our financial solutions make complex calculations related to loan terms and interest rates easier with calculators. This also allows clients to compare different options and make effective choices.

Real-Time Financial Insights

Our AI-driven analytics tools allow clients to have detailed insights into their portfolio performance, investments, and spending habits. This allows financial institutions to maintain transparency with their clients.

Fast and Secure Transactions

Our financial software solutions make online transactions faster with instant money transfers for loan repayments and bill payments, allowing convenience to the fullest.

Push Notifications

Allow your financial clients to have real-time updates for important processes like loan approvals, promotional offers, and transaction statuses through push notifications.

Our Work Process for Financial Software

Development

At Technocrats Horizons, we do not believe in a one-size-fits-all approach. And that's why we follow an agile development approach to have detailed insights of your business needs and goals which allows us to craft tailored solutions for your effective growth.

Cutting-Edge Technologies We Use for

Fintech Software Development

We are technology beacons assuring lasting growth. That's why our solutions are accompanied by leading technologies to allow precise efficiency, scalability, and engagement.

AI/ML

With AI empowering the digital world, we leverage it in our fintech solutions for predictive analysis, automation, and personalized recommendations, allowing you to enhance client engagement and decision-making processes.

Blockchain

We leverage blockchain technology to allow secure and transparent transactions in various finance processes like online payments and asset tokenization. Blockchain technology will enable you to build trust in your clients' minds and also eliminate the risks of financial fraud.

Cloud Computing

With cloud solutions known for enhancing software performance and simplifying data processing, we leverage cloud computing to make your fintech solutions scalable enough to handle large amounts of data with ease.

IoT (Internet of Things)

We use IoT technology to connect financial devices and enable processes like automated payments and real-time asset monitoring. This allows you to offer convenience to your clients in terms of interactions and accessibility.

Explore the power of tailored fintech solutions designed to scale with your growth.

GET IN TOUCH NOW!

Our Work: Innovations We Brought in the Finance

Sector

At Technocrats Horizons, we have a proven track record of transforming numerous financial businesses with our powerful and growth-driven solutions. Here are the insights of some of our fintech projects that demonstrate our expertise and creative thinking.

Home Loan Team

Home Loan Team, is a dedicated group of Mortgage Brokers with expertise encompassing the entire spectrum of Home Finance.

View Case StudyWhy Choose Technocrats Horizons

for Financial Software Development?

Being a prominent player in the fintech industry, we understand that financial businesses need more than mere technological solutions. By blending innovation, agility, collaboration, and our industry expertise, we craft solutions that make climbing the success ladder for your financial business much easier.

Industry Expertise

Industry Expertise

Our fintech software development company possesses 13+ years of expertise in the financial domain. Our expertise has allowed us to achieve a profound understanding of the varied challenges faced by the finance businesses. This allows us to craft software solutions that simplify complex operations and enhance growth effectively.

Using Future-Proof Technology Stack

Using Future-Proof Technology Stack

In today's digital era, it becomes necessary for financial businesses to have solutions that can easily adapt to evolving business needs. That's why custom software development for financial services involves using leading-edge technologies and tech-stack to make your business future-ready.

User-Centric Development

User-Centric Development

Having a deeper understanding of the complexities involved in financial service operations, we build solutions that are easily accessible by both financial firms and clients, ensuring engagement and poor user interface do not become roadblocks to your success.

Long-Term Support and Maintenance

Long-Term Support and Maintenance

Once you connect with Technocrats Horizons, there's no looking back. We always hold our customers back to allow them to use our fintech solutions hassle-free.

Your next-gen financial platform development

starts here - Let's bring your vision to life!

CONTACT US NOW

Frequently Asked Questions for Financial

Software Development

Some questions might be at the peak in your mind. Here are the answers to the most commonly asked questions for financial software development services.

What kind of fintech solutions do you offer?

How much time does a fintech software development take?

What is the cost of fintech app development?

Do your financial software development services help with regulatory compliance?

Does your financial software development company offer post-launch support?

Any other question?

Ask any other question apart from these questions.

Our Blogs

Get insights about the trending digital innovations in the finance industry through our blogs.

How Much Does it Cost to Build an AI-Based Finance App Like Plaid?

Plaid is one of the most popular AI finance apps. The reason behind its extreme popularity is the personalized user...

Financial Software Development: How It is Transforming Finance Sector

Custom software development plays an impactful role in advancing every industry, including finance. The reason behind this growing trend is...

Build A Money Management App Like Mint

What is the reason Personal Money Management apps are in high demand? The development of a successful personal financial application...

Request a

Request a

Industry Expertise

Industry Expertise Using Future-Proof Technology Stack

Using Future-Proof Technology Stack User-Centric Development

User-Centric Development Long-Term Support and Maintenance

Long-Term Support and Maintenance