Plaid is one of the most popular AI finance apps. The reason behind its extreme popularity is the personalized user experience and high-end security it delivers to its users. While navigating Plaid, you might wonder if you could have such a fantastic AI finance app. Of course, it is possible to develop a finance app like Plaid. However, you must use AI as Plaid is an AI-based finance app. From personalized suggestions to high-end security to automation, Plaid uses AI at every step. And this is what makes Plaid unique from other finance apps.

Conventional finance apps would have basic functionalities like login signup, attractive design, and generalized financial suggestions. When it comes to personalization and interactive design, AI wins hearts. AI allows your finance app to enhance the user experience through chatbots and virtual assistants. The chatbots make the end-users feel you are constantly having their backs. Moreover, AI takes personalization one step further through its personalized recommendation features. AI would analyze user behavior and suggest financial goals to individuals instead of generalized suggestions.

Moreover, regarding finance apps, data security is the primary concern, and AI again stays strong as it enhances security measures through data encryption and user authentication protocols.

So, you can wonder what magic AI can bring to your finance app. Such high-end personalization, interactive design, and data security allow you to boost app ROI. However, people often neglect AI, thinking it is costly. But if you think about its long-term benefits, AI proves to be cost-effective. That’s the reason why Plaid has become extremely popular by using AI.

If you are considering developing an AI-based finance app, you must know the development cost. This blog will tell you the ultimate cost breakdown of how much it costs to build an AI-based finance app like Plaid.

What is Plaid, and Why Develop an AI Finance App Like it?

Plaid is an intermediary software that allows you to share your financial information with other financial applications. Numerous finance apps like Venmo, YNAB, and Privacy need your financial details for proper functioning. For instance, a budget app would require your credit or debit card transaction details to prepare a monthly budget. In such circumstances, users shared their entire bank details, from account numbers to transaction details, which were prone to fraudulent activities.

Intermediary finance apps like Plaid became a boon for all users, providing a secure platform to share the required financial information securely. Plaid will automatically share the necessary information with the app if you want to use a budgeting app like YNAB instead of manually entering the transaction details and other financial information.

You might wonder why you should have a finance app like Plaid. The sole reason is the secure way Plaid helps you share your sensitive financial information with other apps. Here are the numerous reasons why you should build a finance app like Plaid:

- You can connect with numerous financial apps with minimalist banking information.

- It allows you to share your crucial banking information with robust security measures, including data authentication and encryption.

- With Plaid on your side, you have complete control over sharing your crucial information. You have the full authority to decide how much and for how long you want to share the data.

These great benefits of Plaid have made it a trustworthy finance app for 11,000 users.

Reasons Why You Should Use AI in Finance Apps

Perform Thorough Data Analysis

Manual data analysis can be time-consuming, complex, and prone to errors. Finance apps require the analysis of data numerous times. For instance, to give insights about saving money, the finance app needs to analyze the money-spending patterns of your customers. AI provides us with a sigh of relief through its detailed data analysis process. It allows us to perform a thorough historical data analysis that helps you make informed decisions quickly. Besides this,

AI-powered finance apps also give you insights about future trends that will enable you to enhance your finance business growth, making you stand ahead of your competitors.

Besides, AI helps finance apps analyze the services that the users haven’t used for a long time, and based on the analysis, it can suggest that your customers cancel such unused services, saving them unnecessary money-spending.

Automate Complex Tasks

Finance apps need to perform numerous tasks like tracking the everyday expenses of customers, categorizing the different transactions, reminding the bills, and more. Manual processing of these tasks is going to be time-consuming. Moreover, manual processing will be cumbersome, which will lead to a lot of errors. AI streamlines such time-consuming, complex tasks with automation. Furthermore, AI automation is precise and accurate, with minimum chances of errors.

AI-powered finance apps can also save customers from unnecessary spending through task automation. Automated bill reminders allow customers to pay their bills on time, keeping them from excessive penalties. Besides, AI helps the finance apps to analyze the services that the

Unlock the Power of AI in Finance Apps Today!

Enhance User Experience

Every person’s financial situation is going to be different. That’s why finance apps must provide tailored budget plans and investment suggestions. For this, finance apps should know the spending patterns of individual customers. However, it is not possible manually. AI allows you to understand individual spending patterns and behavior through behavioral analysis. This will enable you to give personalized financial assistance in investment and budget maintenance, helping you drive customized user experience in your finance app.

Besides this, AI enhances the user experience of finance apps through real-time chat applications like chatbots and virtual assistants. AI personal finance assistants have become robust support for customers in resolving their queries and getting precise financial assistance instantly.

Provide Enhanced Security

Finance apps contain critical information related to banking activities, which are prone to fraud. That’s why it becomes a necessity for finance apps to follow high-security protocols to keep the user data secure. Conventional finance apps do provide security to your data. However, the data does not remain completely safe with general security measures. That’s the reason why fraudulent activities have increased nowadays. When providing high-end security, AI becomes your ultimate savior with high-security measures like end-to-end data encryption and user authentication. AI-powered security protocols ensure your data remains healthy and safe always.

With the help of behavioural analysis, AI can identify sudden, unusual transactions and immediately notify the account holder while temporarily blocking the account to prevent further fraudulent activity. Thus, AI makes your finance app ten times more secure than the usual finance applications.

Complete Cost-Breakdown to Build an AI-Based Finance App

Seeing the numerous benefits of an AI-based finance app, you might consider developing it. But before you start finding the right AI app development partner, you should know the cost of AI-based finance app development.

AI finance app development usually needs $40,000 to $2,00,000. This cost can vary depending on the complexity of the application and the features you need to embed in the application. AI finance app development involves five development stages that contribute to development costs. Let’s break down each development stage to know the cost needed in each developing stage.

Extensive Planning and Researching

The AI world is upgrading at a fast pace, and so are the AI app development technologies. You must incorporate the latest AI technologies and trends to develop a high-performing and engaging AI finance app. For this, you need to perform extensive research. Based on the study, you need to plan the design of the finance app strategically. The research and planning process can become lengthy if you need to add some complex features to your finance app. However, extensive research is crucial for getting a high-performing, user-friendly finance app.

Usually, the research and planning process requires an investment of $5,000 to $15,000.

Design and Development

For any finance app, the user interface plays a crucial role in driving engagement. The more intuitive the user interface is, the more users are attracted to your app. An AI finance app will need numerous features like AI-powered finance assistants, personalized recommendations, seamless navigation, and more to drive user engagement. You will need an investment of $10,000 to $30,000 to embed these AI features in your app.

After the design phase comes the development phase, which includes the front-end and back-end development processes. The frontend process implements the smooth functioning of your finance app’s desired features. The backend process, on the other hand, allows you to manage the database and servers. The overall development cost of the finance app is between $20,000 to $70,000.

Curious About the Cost of Building an AI-Based Finance App? Find Out Now!

AI/ML Model Training and Integration

To develop an AI-based finance app, you must build and train an AI model. It might seem to be an easy process. However, it is not. Initially, you need to develop various algorithms for data analysis, security, and personalization, which requires an investment of $20,000 to $50,000. Next, you must train the designed model by incorporating all the necessary algorithms. Once trained, you must rigorously test the model to ensure it is error-free. The AI testing usually requires a minimum investment of $15,000 to $40,000.

After successful testing, you can integrate the AI model into your designed finance app. The overall AI/ML model integration costs $50,000 to $150,000.

Testing Your Designed AI Finance App

The testing process is one of the most significant processes for your AI-powered finance app’s success. Imagine launching your app without testing it and the app showing errors in terms of performance. Such errors would surely hinder your finance app’s user experience, leading to app users’ loss. A thorough testing before the app launch saves you from incurring significant losses.

Although you have tested the integrated AI model, it is necessary to test the overall performance and security, which involves an investment of $10,000 to $25,000.

Deploying and Maintaining the Finance App

After successfully testing your AI finance app, you will need to launch the app in the App Store. For this, you will need to incur the cost of $3,000 to $5,000. The AI finance app development process does not stop after the deployment process. To ensure your finance app always performs smoothly without any bugs or errors in the future, you need to maintain it on a timely basis, which again requires some investment.

Post-launch, you must keep checking your finance app, which requires an investment of $7,000 to $15,000. Annual maintenance includes updating your app with necessary features, which cost $5,000 to $10,000. Although the yearly maintenance costs might seem costly, they benefit your finance app in the long run.

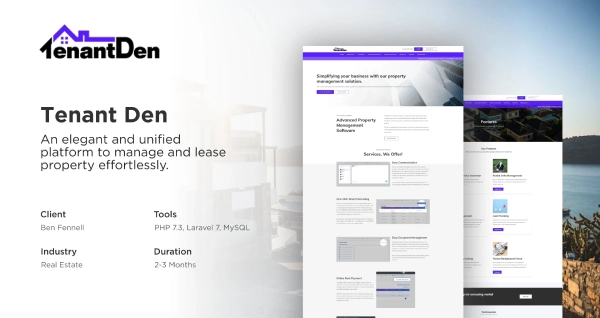

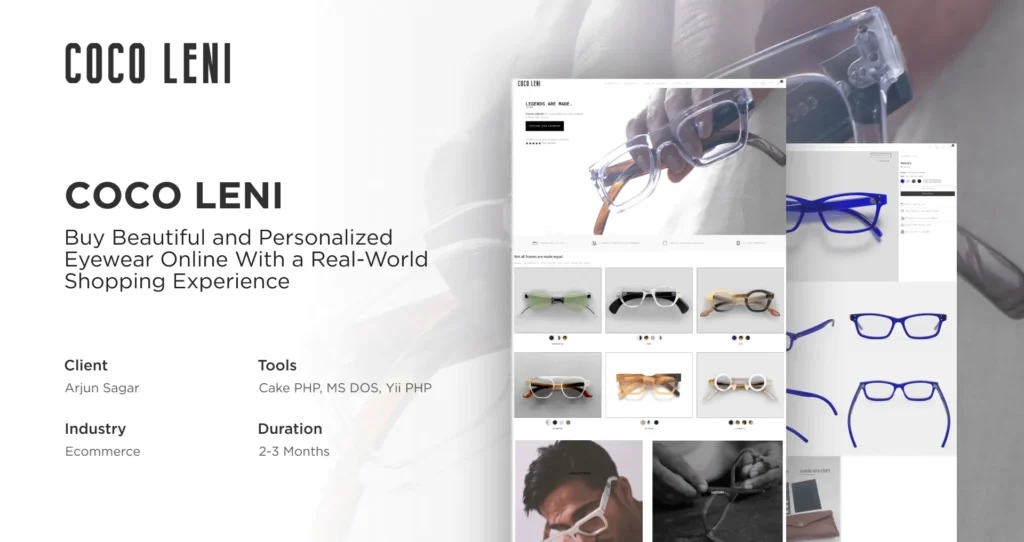

How Technocrats Horizons Becomes a Perfect Partner for Developing an AI-Based Finance App Like Plaid

Technocrats Horizons is one of the best AI personal finance app development companies. With 13 years of expertise, we have gained extensive knowledge about the finance sector and AI development technologies.

We develop custom AI-powered finance solutions that become eligible to fulfil diverse finance business needs effectively. From detailed expense analysis to personalized financial suggestions to automating complex processes to high-end security, our AI-powered solutions help your finance app to enhance growth and boost ROI.

Building an AI-based finance app like Plaid might seem a bit complex, but by partnering with Technocrats Horizons, you affordably simplify the app development process.

Want to develop a finance app like Plaid? Book a free consultation call today to learn how Technocrats Horizons can become your perfect helping AI development partner.

Looking to build a Plaid like AI Based FinTech App?

AI is the future of technology! Adapt Now!

Get a free consultation to see how our AI experts can transform your business processes.

Request a

Request a