It’s true that no one would like to keep track of their spending by scouring into piles of invoices. However, keeping track of how you manage your money is crucial, especially since saving is now a necessity of survival.

Personal money management apps are an effective solution to inefficient budgeting and excessive spending. They provide a lot of benefits to the users and are highly sought-after making an app to manage money is an investment worth making. Let’s explore the advantages and drawbacks of tracking and budgeting android and iPhone app development by examining one in person.

Find out more about the personal financial management apps like Mint are able to provide.

What is the reason Personal Money Management apps are in high demand?

The development of a successful personal financial application (like Mint or another one) is not possible unless you know the demographics of your customers and why they’ll need this software. We’re trying to understand currently. So let’s do it!

It isn’t important the age you’re at or what you do to earn an income. You’re still faced with the challenge of budgeting. Avoiding it is a mistake and here’s the reason.

We all will make an impulsive purchase from time to time and then regret it. Most of the time, it’s something costly, but not worth it. You can steer clear of (or cut down on) the amount you spend by monitoring your finances and arranging your expenses.

Modern technology, such as the budget planner app can help you in this. It’s much more practical than a paper notebook in part because your phone is all-accessible!

What are the benefits of using apps for personal finance and mobile?

Personal finance apps can help you monitor and manage your earnings and expenses. They come with a myriad of beneficial options, which we’ll go over in the future. In the meantime, let’s take an overview of the most important advantages of different mobile financial planners.

-

Data visualization and visibility

All financial information you have is converted into clear and vibrant graphs and charts which makes it more appealing as well as suitable for future usage and accurate budgeting.

-

Data synchronization

A budgeting application similar to Mint and other top brands includes the possibility of connecting all your accounts to your finances and then synchronizing all relevant data.

-

Automation

A portion of the procedures that are involved in budget planning could be automated, and you can reduce the stress of your daily life.

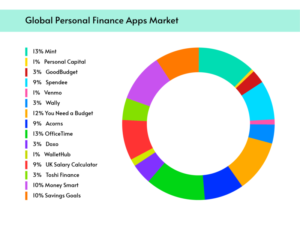

The market for Personal Finance Software: The Global Personal Finance Software Market

- The market for Fintech targets personal financial values of $ 710 million or more.

- Budget management applications of all types were downloaded over 25 billion times this year.

- Based on the latest statistics More than half of users of smartphones utilize fintech apps.

- The fintech industry is increasingly sought-after and the amount of transactions per year is increasing (so far, it has exceeded $700K).

What do the fintech markets provide in the present? What are the factors to consider when trying in order to create a product that is successful? At the end of the day, the cost of building an app for personal financial planning such as Mint isn’t cheap, therefore you must be careful to stay clear of any potential traps.

Remember other fintech applications

Be aware of the direct competition you’ll need to face. The most well-known ones in the image above (and we’ve listed a few in the next section).

Mint isn’t the only competition you’ll encounter, so you must be prepared.

The choice of mobile Personal Finance Apps

What’s the first thing that users are looking at when they select Fintech-related applications? With this knowledge is the first thing you can do to design your own development plan:

-

It is the number of OS that are supported

Which platforms will the application operate with? Which platforms are supported by the app? The ideal choice is one that is compatible with each Apple as well as Android device.

-

User-friendly

Of course, users pay close attention to whether the app is well-designed. Are you able to use it?

-

Features

What is the quality of the app? Does it include all the tools that users require to control their finances?

In the meantime, we will discuss the most effective attributes of personal finance app development in the next article. -

Cost of use

A good budget management program shouldn’t depress the earnings of the user. Its purpose is to help him to manage his expenses.

Mint is able to meet all specifications and is thus popular with users. If you’re looking to know how to develop an application for fintech, you should focus on Mint. It’s your model to follow.

What’s Mint?

It’s no exaggeration to declare that Mint is the top of the line for fintech applications with a focus on budgeting. Mint has a stellar reputation that has allowed it to gain 20 million or more users. Its user base continues to grow.

Mint offers a variety of excellent features and tools, that let users automatize and streamline budgeting and make savings at the final. In the end, the primary job of the Mint is to expose the nature of your expenditures and change your spending habits for the better, and show you how to handle your cash in the most efficient possible manner.

The first time you use Mint by synchronizing your accounts that are in some way connected to your financial situation. Mint will then break down your expenses into the appropriate categories whether it’s food, lifestyle, utilities, or entertainment. Naturally, there are times when Mint does not do the right thing when it comes to categorizing your expenditure However, the issue can be rectified by hand.

What’s great about Mint?

- Mint is renowned for its easy-to-use interface. The app is extremely user-friendly

- Mint is available for free and also boosts its score.

- Mint can be used on equally iOS in addition to Android operating systems. which means users on any device will download Mint. Mint application. If you plan to build a budget-management application like mint, it is essential to follow its example. With a limited budget for development, you could begin with only one OS and later on, make certain to upgrade to a different version, too.

- A lot of people use Mint to see a complete view of their financial position (they simply need to connect their accounts with financial institutions Mint).

- The categorization of expenses is an important thing as well and helps to build customer loyalty.

- Mint lets you learn from the top. Mint analyses the trends in the market, and the financial habits of other users, and using the information it collects gives the most effective method of budgeting.

- It’s the same for investments: it’s an excellent opportunity to evaluate your investments with market averages.

You now know the reason Mint is a great role model, and why its users love it (why they pick the app). However, before we show you how to create a new app for managing finances like mint, we’ll go over various other questions. Beginning with this one.

Essential Features to have in a Budgeting App such as Mint

Let’s first focus on the functions your application will not be able to live without:

-

Register / Login

Of course, it isn’t possible to do this without registering. The entire process should be easy, reliable, and safe.

-

Access to account

After registration, the user will be able to access his account and has the capability to manage personal data (if required).

-

Security

This cannot be described as a feature in the complete sense, but we cannot leave it out. Security of data is always a concern especially when it comes to managing money application development. Be aware of this and apply security measures such as multi-factor authentication, face (or fingerprint) recognition, and many more.

-

Manage your bills

We all have various bills that we need to pay every now and then. However, sometimes we have so many things to be done that we don’t remember a deadline… therefore, it’s a good idea to create an app for financial management that reminds users of when they have for paying their bills, and they’ll feel thankful.

-

Cost management

Of course, one of the most essential attributes is the ability to effectively manage your costs. This means separating costs as well as setting spending limits and other aspects to aid users in taking control of their expenses in a timely manner.

-

The data sync

Cost management is only efficient if all the relevant data is continuously updated. Therefore, make sure you include the sync feature in the aspects of your personal finance mobile app development.

- The data we’re discussing is associated with the transfer of funds into the bank account of the user as well as his credit bank and information about loans, that kind of thing.

-

Notifications

The feature is an absolute must for all applications which is why you must add this option to your application’s capabilities. Inform customers about anything that could be of interest and helpful to them.

-

Analytics

The collection and analysis of spending data and transforming it into reports that are detailed is yet another aspect to think about when creating an app for budget planning that is custom such as mint.

-

Application support

We hope your application will function as smoothly and users won’t be faced with any issues or questions… however, everything can go wrong, and that implies that 24/7 support isn’t a bad thing either.

We’ll now discuss other (and somewhat optional) options. We recommend that you add them to the premium (paid) feature:

-

Analysis of investments

The feature is designed for those looking to make investment decisions that are smart and secure. The app can look over information taken from different sources, and then provide helpful suggestions.

-

Gaming

Of course, the personal finance application isn’t designed to be enjoyable however, why should it be dull to utilize? You could always add a fun element to improve user engagement. What are the reward points users earn if they are able to meet a certain goal (say costs savings or something else)? It’s up to you to develop your own concept, however!

-

AI-based advice

We’ve already mentioned Mint’s ability to advise users on the best direction to follow (regarding the optimization of their spending as well as improving the way they manage their finances). In order to use the feature effectively it is necessary to turn to artificial intelligence. Through analyzing the actions of all its users the AI-based program develops and is able to make actual suggestions.

If you are working with a small budget, consider MVP to manage your money with app development. This means that you develop only the most essential features (from the initial list). In the case of additional features, you may add them later on when your solution is able to generate profits.

Our team has the expertise to create a personal finance application like mint entirely from scratch. We also have extensive experience in development. We’ll ensure you receive the product that will meet your expectations to the fullest extent.

Get App Solutions That Immediately Stand Out!

Talk to our experts to understand how our app solutions can boost your productivity.

Request a

Request a